Japan Gold Corp.’s leadership team has long recognized Japan’s prospectivity for gold, silver and copper. When Japan’s Mining Act was changed in 2012 to re-activate the mining industry, Japan Gold moved quickly to review historical data and identify key exploration targets and was the first foreign exploration company to apply for prospecting licenses.

The Tertiary volcanic arc terrains of Japan host more than seventy significant historic producing gold mines, including five greater than 1 million-plus-ounce gold deposits. This includes one of the world’s highest-grade gold mines, the Hishikari Mine on the island of Kyushu. The Hishikari Mine produced approximately 9 million ounces of gold (8.6 Moz Au past production 1985-2024, 4.98 Moz Au reserves) between 1985-2024 at an average grade of +20 g/t Au and is still producing today.

Despite being a first-world country with a rich history of gold mining, there has been very little exploration in Japan since World War II when gold mining was suspended due to a government moratorium. When the Japan Mining Act was amended in 2012 for the first time allowing foreign mineral companies the ability to hold exploration and mining permits, Japan Gold was the first company to seize this opportunity.

Japan Gold completed a review of the Metal Mining Agency of Japan database, which includes detailed and relevant information about historical drilling results and mine production. The review of Japan’s extensive geoscientific database and historical gold production data served to pinpoint areas with good exploration potential and led Japan Gold to build an exploration portfolio with its first submission of prospecting rights applications in late 2014.

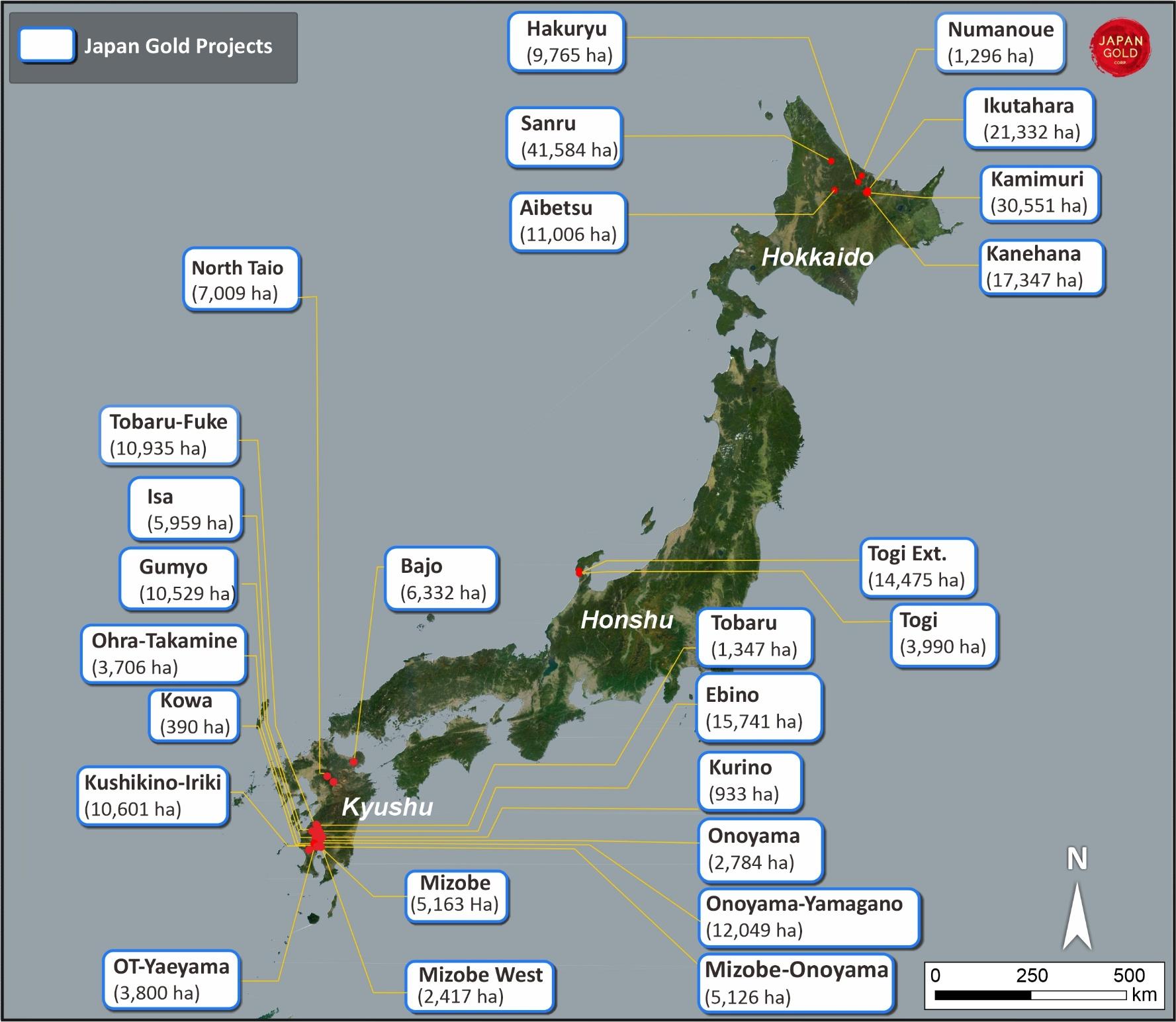

Japan Gold’s portfolio consists of 26 tenements across Japan's three largest islands, Hokkaido, Honshu, and Kyushu. Projects include areas with historic gold production and are prospective for high-grade epithermal gold mineralization.

Japan Gold currently holds a total of 977 prospecting rights license applications accepted by the Ministry of Economy, Trade and Industry, (“METI”), of which 220 have been granted as prospecting rights licenses. Having prospecting rights applications accepted by METI reserves the land for Japan Gold and allows for active surface exploration programs such as mapping, surface sampling and geophysics. Granting of Prospecting Rights licenses by METI allows for more advanced forms of exploration, such as drilling.